Global analyst talent, ready to drive your success

Curious about offshoring?

Offshoring can elevate your operations with cost-effective, high-performing analysts.

Ready to enhance your offshore setup?

Got a captive or a third-party provider? Top financial institutions trust us for superior analysis.

Counterparty Credit Risk

◆

Credit Investment & Trading

◆

Commercial Loans

◆

Market Risk Modelling

◆

Equity Research

◆

Counterparty Credit Risk ◆ Credit Investment & Trading ◆ Commercial Loans ◆ Market Risk Modelling ◆ Equity Research ◆

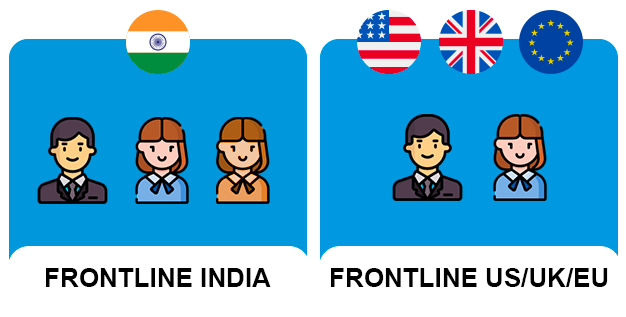

Global talent

Trained & guided the City way

Our world-class training programs are led by City of London and Wall Street veterans. We then support our graduate top-tier analysts to seamlessly integrate into your global teams, wherever you’re based.

Integrated global solutions, tailored for you

Onsite and offshore

Analysts working both in your office and offshore, seamlessly integrated for easy communication and feedback. After two years, recruit your consultants into your team for long-term value.

Offshore only

A dedicated team of top-tier analysts, trained by Europe-based veterans, working offshore but directly for you. Maximize value with proactive, highly communicative analysts from world-class MBA programs.

Low turnover, seamless communication

Our analysts build long-lasting relationships with clients. Their exceptional communication skills and dedication lead to low turnover and consistent team integration, making them valuable assets over time.

City analysts are made not born

Veteran trainers

Our trainers are seasoned veterans from the City of London, each with over 20 years of experience in global markets.

Real-world apprenticeships

Our apprenticeship model, developed since 2005, ensures hands-on training and continuous development under senior bankers.

Established 2005

With 20 years of experience, we’ve built strong relationships with top banks and asset managers across the globe.

Validated AI solutions

We harness the power of AI to transform how you work. Our analysts expertly integrate advanced AI tools to optimise processes, boost efficiency and unlock valuable insights across global capital markets. From automating complex tasks to enhancing data analysis, we ensure AI is applied where it has the greatest impact. Every AI-driven solution is thoroughly tested and aligned with your unique business needs, delivering precise, reliable outcomes.

London-based client support

We prioritise seamless communication and long-term success. Our Client Support team in London, made up of seasoned European bankers and risk managers, ensures that your needs are continuously met. While our analysts handle day-to-day project delivery and communication, the London team stays actively involved, fine-tuning every aspect of the engagement to guarantee the best outcomes for your business.